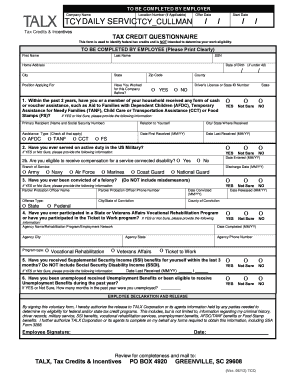

work opportunity tax credit questionnaire required

WOTC Quick Reference Guide for. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups.

Pin By Maritza Corrales On Books Books Pandora Screenshot Pandora

Is participating in the WOTC program offered by the government.

. Required Certification Forms for the Work Opportunity Tax Credit WOTC Employers are required to certify that a potential employee is a. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. For more information on the ERC visit the IRS website.

Employers can still hire these individuals if they so choose but will not be able to claim the tax credit. This tax credit program has been extended until December 31 2025. WOTC-certified employees must work at least 120 hours during the first year of employment for an employer to claim credits which are calculated as a percentage of qualified wages.

The answers are not supposed to give preference to applicants. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

Use IRS Form 5884 when filing annual tax returns to claim the WOTC. The Work Opportunity Tax Credit is a voluntary program. Qualify for a credit of up to 16400 for that employee by claiming both the WOTC and the ERC provided that the same wages are not used to calculate the WOTC and the ERC.

This is the Ernst Youngs vendor survey site. In over 20 years of providing valuable WOTC Screening and Administration services weve saved millions for our customers. A date in the future.

The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically faced significant barriers to employment. Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file. The tax credit for target group I long-term family assistance recipient is 40 percent of first year qualified wages up to 10000 and 50 percent of second year qualified wages up to 10000.

Work Opportunity Tax Credit Questionnaire. Page number one of Form 8850 contains the questionnaire of the Work Opportunity Tax Credit. The Date of Birth DOB field does not allow.

Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person. The program has been. Updated on September 14 2021.

It contains questions related to their previous life such as if they have worked in any military service their participation in any government assistance programs recent unemployment and other targeted questions. The WOTC survey displays in the current browser window. The Work Opportunity Tax Credit WOTC can help you get a job If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. Enter the required information. Call 800-517-9099 or click here to.

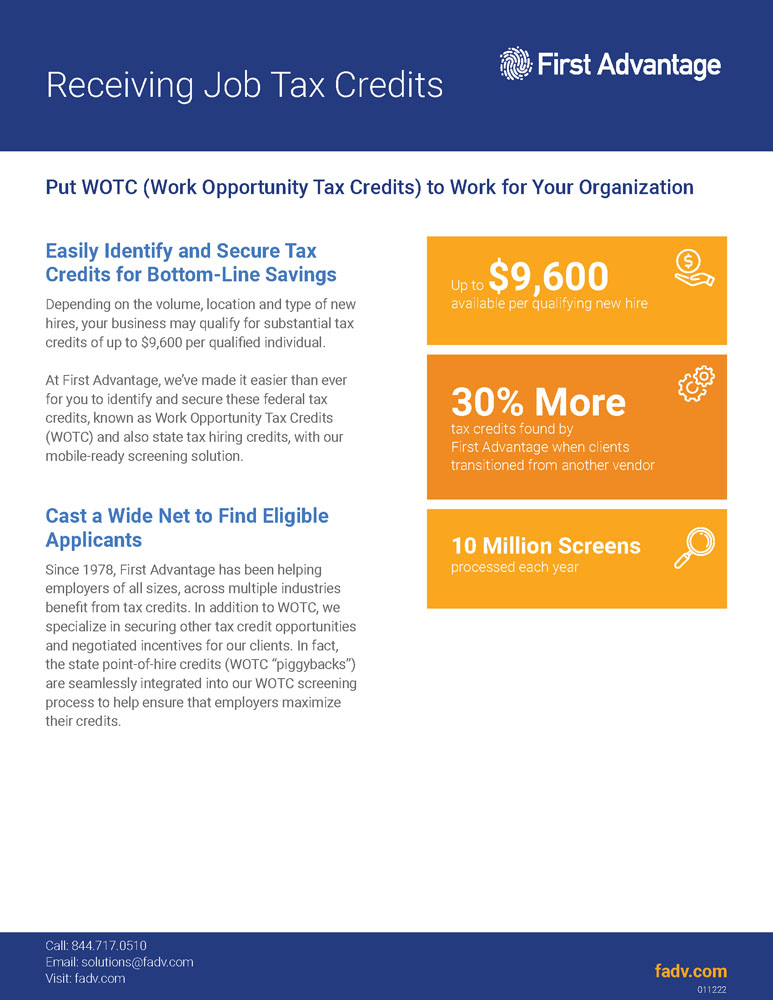

If youre interested in taking advantage of the WOTC its important to know. This government program offers participating companies between 2400 9600 per new qualifying hire. This is so your employer can take the Work Opportunity Tax Credit.

Contact CMS Today to Start Saving. WOTC Work Opportunity Tax Credit Questionnaire K S Staffing Solutions Inc. Below you will find the steps to complete the WOTC both ways.

In certain circumstances you may be able to claim either the 40 percent of 6000 tax credit or the 40 percent of 10000. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The WOTC Questionnaire asks questions that are not visible to the hiring managers or hr except admins that control the data flow.

Up to 25 of qualified first-year wages for 120 to 400 hours worked. Select the Tax Credit Check task. The individual must be retained at least 180 days or 400 hours.

All employers taxable and nontaxable must wait to claim their WOTC. Employers must apply for and receive a certification. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training Administration Form 9061 and ETA Form 9062.

Employers file Form 5884 to claim the work opportunity credit for qualified 1st- or 2nd-year wages paid to or incurred for. Contact CMS today to start taking advantage. Employers can claim tax credits each year for each employee they hire in this demographic.

Employees in the TANF recipient category must work 400 hours. A date older than 130 years. Up to 40 after the employee has worked 400 hours.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire people in certain target demographics who often experience employment barriers. April 27 2022 by Erin Forst. The employee groups are those that have had significant barriers to employment.

This credit is based on qualified wages paid and the number of hours worked during the first year of employment. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. This tax credit may give the employer the incentive to hire you for the job.

They are allowed to ask you to fill out these forms. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the WOTC eligibility questionnaire. The data is only used if.

Wotc Questions What Is The Work Opportunity Tax Credit Questionnaire Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit Department Of Labor Employment

How To Optimize Wotc Screening Emptech Blog

Work Opportunity Tax Credit What Is Wotc Adp

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1144541711-111b0ab2182848498ec783fa6d5bbd35-b749d033009a41a2903348e46f7bde60.jpg)

How Does The Work Opportunity Tax Credit Work

Work Opportunity Tax Credits Wotc Walton

Wotc Calculator Management Tool Equifax Workforce Solutions

Retrotax Tax Credit Administration Jazzhr Marketplace

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit First Advantage

Leo Work Opportunity Tax Credit

Work Opportunity Tax Credit What Is Wotc Adp

With Wotc Timing Is Everything Wotc Planet

Adp Work Opportunity Tax Credit Wotc Avionte Bold

What Is Wotc Screening Irecruit Applicant Tracking Remote Onboarding